Drake Tax System Requirements

Drake Software is dedicated to providing the best value in professional income tax software. The tax software is fully-featured, allowing you to prepare and e-file federal and state tax returns. Sales: (800) 890-9500 Support: (828) 524-8020 Fax: (828) 349-5701 Compliance: (866) 273-9032. Access online tax research – Search a customizable list of online tax resources. Collect fees – Accept credit and debit card payments within Drake Tax. Import and Export. Electronic W-2s – Download and import for select employers. Schedule D import – Load investment transactions from an Excel or text file. The drake accounting software is developing at a frantic pace. New versions of the software should be released several times a quarter and even several times a month. Update for drake accounting software. There are several reasons for this dynamic. Find Drake Software software downloads at CNET Download.com, the most comprehensive source for safe, trusted, and spyware-free downloads on the Web.

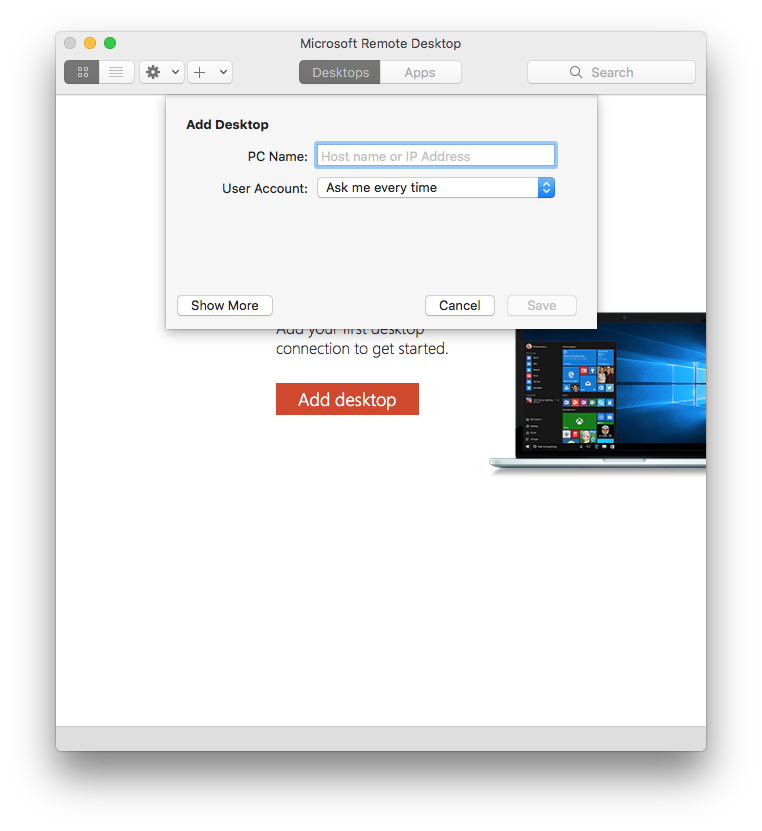

View the minimum and recommended Drake Tax System Requirements.

Pay-Per-Return Details

Drake’s Pay-Per-Return (PPR) version may suit offices that prepare fewer than 85 returns in a year. After you’ve bought 85 returns, you'll be automatically converted to the Unlimited version at no extra cost.

The PPR package includes 15 returns for $330, with additional returns available at $22 each. You may complete numerous states, e-file, or amend a return, and it still counts as only one return.

Some additional points to keep in mind, to help you determine if the PPR version is for you:

- PPR returns are counted as they are created in Drake. To reduce the chances of a return being created in error, SSN validation is required when creating a new return. Each return created in the Quick Estimator will count as one return. Drake test returns do not count.

- An Internet connection is required in order to use Drake PPR.

- When opening a return updated from a prior year, you are prompted to either count the return or open the return as read only. All fields are grayed out in read-only view.

- SSNs or EINs may be changed through File Maintenance, but the new SSN or EIN counts as another return.

- If you select the PPR package, you may buy Drake Accounting Pro for $495 or Forms for $395 (2021 versions).

The drake tax software download is developing at a frantic pace. New versions of the software should be released several times a quarter and even several times a month.

Update for drake tax software download.

There are several reasons for this dynamic:

First, new technologies are emerging, as a result, the equipment is being improved and that, in turn, requires software changes.

Secondly, the needs of users are growing, requirements are increasing and the needs are changing for drake tax software download.

Therefore, it is necessary to monitor changes in the drake tax software download and to update it in a timely manner.

Drake Tax Software Download Mac Installer

/ If you do not update

There are many sources for obtaining information on software.